Specializing in Nonprofit Accounting Services and Tax Compliance

As a nonprofit organization, you face unique challenges that for-profit businesses don’t, such as the annual submission of Form 990, compliance with (OMB) Circular A-133 requirements or paying taxes on unrelated business income. That’s why it pays to have a dedicated team of tax and accounting professionals that specializes in nonprofit accounting and tax compliance on your side.

Make Us Your Go-to for Outsourced Nonprofit Accounting Services.

Using state-of-the-art technology designed for nonprofits, as well as effective communication and proactive tax planning techniques, we make sure that every financial decision you undertake complies with your organization’s bylaws, maximizes your existing funding sources, and reduces costs. Whether you’re an established nonprofit organization, association, foundation, charity, or other service organization or are just getting started turning your idea into reality, we can help.

Here’s what else we do for you:

- Prepare quarterly and annual financial statements

- Submit annual Forms 990 and 990-T

- Prepare supporting documents (income, program and functional expenses, balance sheets, revenue support schedules)

- Comply with state laws affecting nonprofits

- Apply for tax-exempt status under (Section 501(c)(3) – including filing Form 1023 & 1024

- Grant Management

- Auditing Services

Services

Bookkeeping

Minimum Cost $1,100.00

Perfect for emerging nonprofits seeking meticulous record-keeping for transparency and compliance.

- Quarterly transaction recording tailored to nonprofit transactions

- Bank and credit card reconciliation

- Quarterly financial statement generation specific to nonprofit needs

- Quarterly review to ensure grant and donor fund tracking

- Designated fund and donation categorization

- Access to cloud-based bookkeeping software, optimized for nonprofits

Accounting

Minimum Cost $1,300.00

Ideal for established nonprofits requiring detailed financial oversight, including grant reporting and annual audits.

- All features of the Bookkeeping for Nonprofits package

- Annual tax-exempt return preparation and filing (Form 990 or equivalent)

- Tax and exemption advisory services

- Year-end financial statements for board reviews

- Assistance with grant financial reporting

- Oversight of restricted and unrestricted funds

Outsourced CFO

Minimum Cost $2,500.00

Designed for larger nonprofits and foundations needing strategic financial direction, forecasting, and in-depth fiscal insights.

- All features of the Bookkeeping and Nonprofit Accounting packages

- Development of financial strategies aligned with nonprofit missions

- Cash flow forecasting, with a focus on grants and donations

- Budgeting tailored to program needs and grant restrictions

- Performance analysis against nonprofit benchmarks

- Risk assessment with a focus on nonprofit operations

- Regular fiscal consultations for board members and stakeholders

- Custom financial reports, including impact and outcome reporting

Tax Prep

990N (epostcard)

Minimum Cost $300.00

- Annual Gross Receipts normally under $50K

990EZ

Minimum Cost $800.00

- Annual Gross Receipts under $200K

- Total Assets under $500K

990 Full

Minimum Cost $2,000.00

- Annual Gross Receipts over $200K

- Total Assets over $500K

990PF

Minimum Cost $3,000.00

- All Private foundations

1120-H

Minimum Cost $750.00

- Tax return for homeowner and condo association

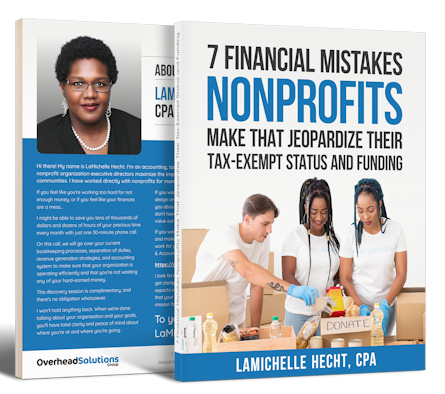

Isn’t It Time You Turned Your Struggling Nonprofit Into a Thriving Organization?

If you’re ready to take your nonprofit to the next level, fill out the contact form today to get started.